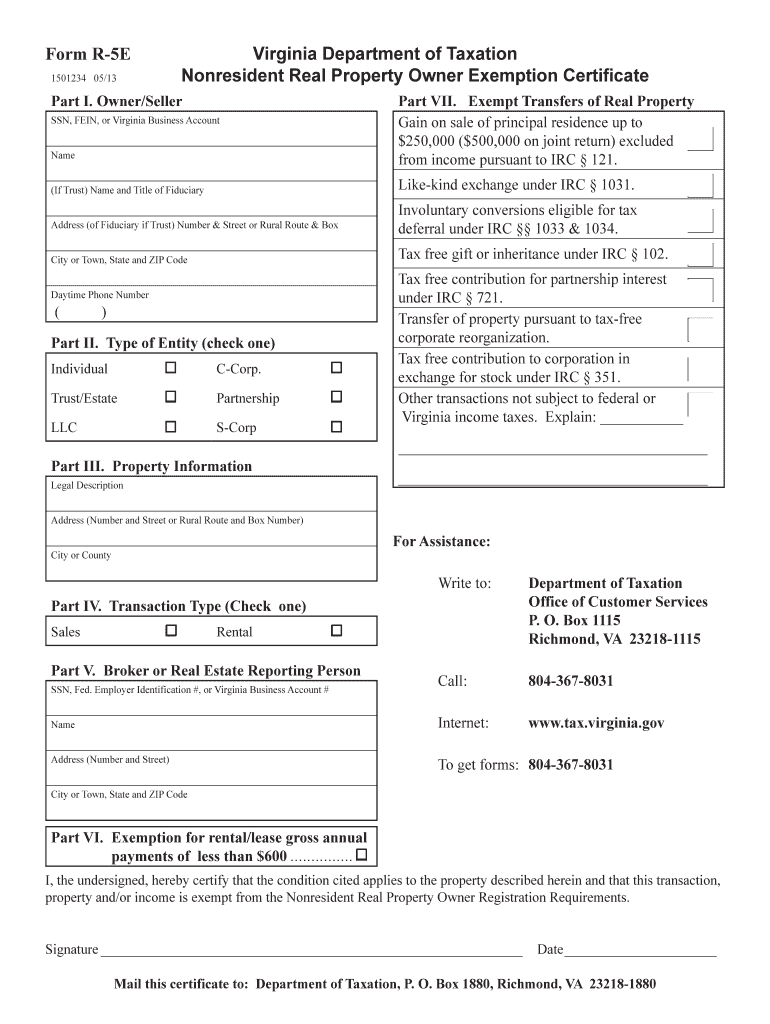

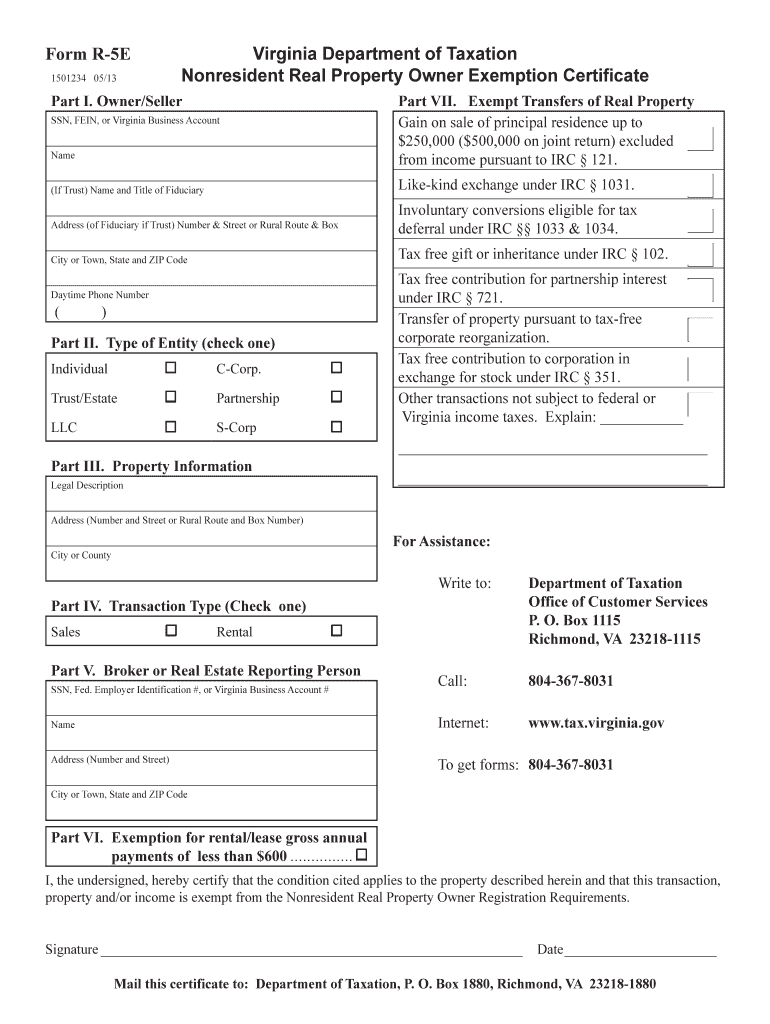

VA DoT R-5E 2013-2025 free printable template

Get, Create, Make and Sign virginia form r 5e

How to edit virginia form r 5e online

VA DoT R-5E Form Versions

How to fill out form 8283

How to fill out VA DoT R-5E

Who needs VA DoT R-5E?

Video instructions and help with filling out and completing complete tax

Instructions and Help about r 5e instructions form

Hi my name is Kane, and I'm here to help you today we're going to show you how to make a category 5 and category 6 patch cable I've found in my travels that nobody knows how to make this even big network administrator's who like make more money than me, and they run my network, and they're like hey I need a patch cable do you know how to make it no I don't here let me get a diagram I learned how to make this when I was 14 you should know how to make these they're simple they're easy we're in a category 5e or cat 5e h cable, so we're going to have a length of cable that we selected we've got one about 10 feet right here, and we're going to need two modular plugs rj45 we also have our cat 6 which we also have about 10 feet of cable here, and we have a category 6 modular plugs also going to need a rj45 crimping tool these seams you can pick up your local hardware store Home Depot Lowe's that kind of things you can ply them online they're relatively inexpensive, and you can use these to make hundreds of cables this one's 300 years old people will always ask you what's the difference between cat5e and cat6 and first and foremost cat6 is a bigger cable it is a higher standard of cable it is able to shoot gigabit networks down with a lot less crosstalk which is the noise that is made with the electricity running over the wires talking to each other, and it creates a slows down your network if you got too much crosstalk so cat 5e will be good for gigabit cat 6 is just better for gigabit networks if you find cat 5 cable which does not have the e it will not work for gigabit networks at all just don't try if it's not cool you like why is my network so slow it's because you're not using good enough cable also if you're doing this out of your home cat 6 is expensive by comparison to cat 5e we're talking like 30 cents a foot versus cat 5e which is probably like 15 16 I haven't looked at the prices recently, but it's expensive to get hat 6 so unless you really need the higher standard cable get ratified v it'll do just fine, so we want to scar the cable sheath, so we can break away the sheath and expose our conductors on the inside, so I'm going to use it just a very gentle we're going to scar the cable sheath with the kick cable wire what would the cutter there, and now we're just going to bend the cable you can see the real stress here you can bend it put some stress on it, and it'll break away mm-hmm look at this sheath experiment and once we're here we want to separate out our pairs, and you'll notice this little string here this is actually for pulling back and exposing more of the cable, so you pull this back down this way, and it'll just cut the cable down I'm not going to do it because I don't need any more than this, but you can just very carefully clip that string away here I've undone twisted all of our conductors into our different color codes we've got our orange pair our brown pair a green pair and the blue pair we want them to be in this order...

People Also Ask about virginia form r5e

What form is state of Virginia withholding tax?

Who is exempt from senior citizen property taxes in Virginia?

What is the Virginia form R 5e?

How do I find out how much personal property tax I paid in Virginia?

How are transfer taxes calculated in Virginia?

Who pays real estate transfer tax in Virginia?

What is the Virginia Form R 5e?

What is considered taxable income in Virginia?

Do I have to file a Virginia non resident tax return?

What do I attach to my Virginia tax return?

How do I file a non resident tax return in Virginia?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in va r 5e nonresident fillable without leaving Chrome?

Can I edit form 5e on an iOS device?

How do I fill out r 5e certificate fillable on an Android device?

What is VA DoT R-5E?

Who is required to file VA DoT R-5E?

How to fill out VA DoT R-5E?

What is the purpose of VA DoT R-5E?

What information must be reported on VA DoT R-5E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.